In India, Travel and tourism industry is one of the largest one and significant employment generators.). According to the UN’s World Tourism Organization (UNWTO), the travel and tourism industry offers 6-7 percent of the world’s total jobs honestly and much more indirectly through the multiplier effect. Among 184 countries in terms of GDP contribution and the tourism industry, the travel and tourism industry in India is ranked 12th and the tourism industry in India is set to grow at 7.8% per year during 2013-2023.

Read on to know how to start tourism business in India by following few steps -

Choice Of Business Entity

Travel agents today have a number of options of business entity to opt from and the business plan for the project would play a main role in finding the right fit. Most travel agents opt for the Private Limited Company as it is one of the most extensively used and renowned forms of business in India offering a number of advantages.. For entrepreneurs, a private limited company is a must for those who have plans to offer their services online and quickly scale up their business using the power of the internet. On the contrary, recently introduced business entities like Limited Liability Partnership (LLP) or One Person Company (OPC) would be perfect for entrepreneurs who have plans to slowly build the business and/or do it on a part-time basis. As Limited Liability partnerships have no obligation for audit unless the turnover goes beyond Rs.40 lakhs in a year, Entrepreneurs can also go for proprietorship’s with a trademark, in cases where the entrepreneur wants to have an exclusive brand name, which is out of stock to be registered with the Ministry of Company Affairs due to the naming guidelines.

GET FREE TRAVEL LEADSService Tax Registration

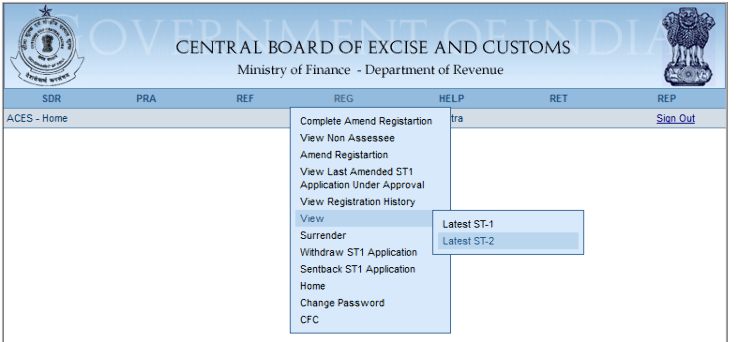

The services offered by a travel agent are taxable under service tax and so travel agent is entailed to attain a service tax registration. However, small-scale travel agents have the choice of getting service tax exemption in case the collective turnover of taxable services is not more than Rs. 10 lakhs in a financial year. Therefore, if the aggregate value of taxable services, does not cross Rs.10 lakhs in a financial year, the travel agent can get the advantage of service tax exemption and not pay service tax until the turnover goes more than Rs.10 lakhs in a financial year.

GET FREE TRAVEL LEADSBecoming A Government Of India Approved Travel Agent

It is not compulsory to have approved Travel Agent registration from Government of India. However, if you go for it then definitely it is beneficial and gives recognition for the travel agent. The aim and focus of the scheme for recognition of Travel Agent / Agency (TA) are to persuade quality standard and service in this tourism industry. To be a Government of India recognized travel agent, the travel agent must please a number of requirement on capital invested, on the staff employed, upholding of minimum office space and other stipulations. To the more, the application must be made to the Ministry of tourism in the necessary format to become a Government of India approved Travel Agent.

GET FREE TRAVEL LEADSBecoming an IATA Agent

The International Air Transport Association (IATA) is the trade association for the world’s airlines, representing some 240 airlines or 84% of total air traffic. IATA gives complete training and professional development services for travel agents, and IATA official approval is a very significant seal of approval recognized worldwide. Therefore, it is vital for a travel agent to think becoming IATA members, and enjoy admission to a number of tools and advantages for the same.

Thus these are the requirements which you should look upon if you want to start a travel agency.

GET FREE TRAVEL LEADS